"With Cheese inventories falling and a strong export program in place, cheese prices should slowly gain for the remainder of 2011, with a similar impact on milk prices."

The November Class and Component prices were announced on December 2. Class III milk prices gained 6% reaching $19.07/cwt based on the strength of the current cheese prices. Milk protein increased 11% to $3.23/lb.

Butterfat fell slightly but remained above historical levels, paying $1.95/lb, well above the historic level of $1.50/lb. Milk protein returned to more normal prices, well above the price of butterfat.

This has brought the breakdown of the milk check back to a more normal relationship where protein makes up the majority of the paycheck.

Inventories of cheese and butter returned to more appropriate levels which has in turn brought prices to a more normal relationship.

CHEESE

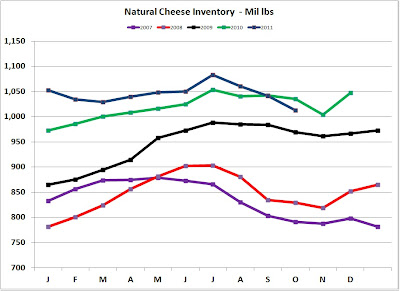

Cheese inventories fell below prior year levels while remaining high compared to historic levels. Lower inventories typically bring higher prices.

This has been accomplished by a very significant drop off in cheese production. For the last six months, cheese production was well below the comparable 2010 production.

Reduced production, combined with continuing good trends in exports, support the reported statistics for the lower inventories. Exports were a record for the month of September, the latest reporting period.

BUTTER

Butter inventories have been very tight for over one year. The low inventory levels have brought high butter prices during this period of time. High butter prices have almost no impact on the Class III milk price. In the last three months we have seen an increase in inventory levels above 2010 levels.

November is typically a cyclical low for butter inventories, and the November 2011 inventory is well above the November 2010 level, substantiating the correction in inventory levels.

Butter production has recovered from the low points of 2009 and 2010 helping to replenish stocks.

Butter exports are low compared to the last 4 years also contributing to the recovery in inventories.

THE FUTURE

The production, exports, and inventories of butter and cheese all seem to be going in the right directions to provide a stable and level field for good component pricing. The only near term cloud on the horizon is exchange rates. The U.S. Dollar has gained respect and strengthened against other currencies. While we can take pride in this, it does make our dairy products higher priced and can therefore have the potential to reduce exports.

While nothing lasts long in today's volatile world, we could not ask for better current prices and trends. Let's enjoy them while they last.

No comments:

Post a Comment